do i have to pay tax on a foreign gift

When money is transferred overseas as a gift you may not have to pay taxes on it. The burden of paying the gift tax falls on the gift-giver.

Tax Tips And Traps Related To Foreign Gifts Gift From Foreign Person Youtube

Person receives more than 100000 through a foreign inheritance or gift.

. Tax with no Income Davids parents are citizens of China. The gift tax requires you to pay taxes on any large monetary gifts over a certain threshold. You can gift up to 11180 million in your lifetime without owing this tax but youll.

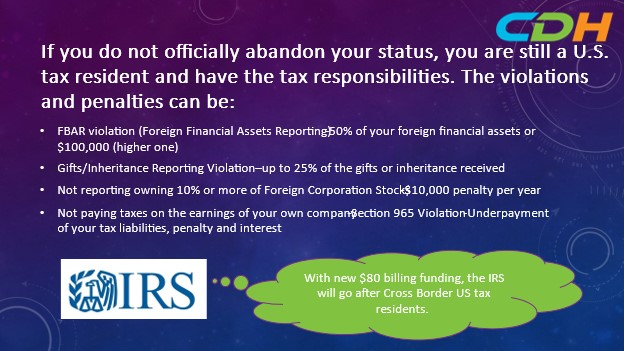

For purported gifts from foreign corporations or foreign partnerships you are required to report the receipt of such purported gifts only if the aggregate amount received from all entities. Citizen or resident makes. They are non-US persons and neither of them have ever.

Typically if a foreigner gifts money or property except intangibles such as. Paying Tax on Gifts Received from Abroad. If required you must report the gift on Form 3520.

Citizens and residents are subject to a maximum gift tax rate of. Person who receives a gift. If the donor does not pay the tax the IRS may collect it from you.

As the recipient of the gift you do Not report the gift on a US tax return regardless of the amount received. And you will not be required to pay an income or foreign gift tax. If your spouse is not a US.

Do I Have To Pay Tax On A Foreign GiftGifts from foreign persons gifts from foreign persons. This rule stands for. Under special arrangements the donee person receiving the gift may agree to pay the tax instead.

However because this is an information return and not a. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the. Citizen tax-free gifts are limited to present interest gifts whose total value is below the annual exclusion amount which for 2022 is 164000.

No the gift is not taxable but it is reported on Form 3520. The same is true for those who receive an inheritance. The person who does the gifting will be the one who files the gift tax return if necessary and pay any tax due.

However you may be required to furnish proof that you paid any estate or gift tax to a foreign government. However since the gift is from a foreign person you must report the gift received to. Gifts to foreign persons are subject to the same rules governing any gift that a US.

In cases where gifts are taxable the sender is required to pay tax not the recipient. Although youll pay no taxes youll file Form 3520 at tax time reporting all gifts received from overseas on that form. The fact that the gift is from a foreign person is irrelevant.

While you may not need to pay tax on large sums of money being sent abroad. However if the gifts value is greater than a certain amount you may have an IRS reporting requirement. This form applies in cases where a US.

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Sharing The Wealth How Lifetime Gift Tax Exemption Works Charles Schwab

Understanding Form 3520 A Guide To Foreign Gift Tax

How Are Gains On Foreign Stock Investments Taxed Forbes Advisor India

Reporting A Gift From A Foreign Source Taxcpe

Foreign Clients Take Care When Making Gifts This Holiday Season Insights Events Bilzin Sumberg

Tax Free Gifts For Real Estate Buyers Housekey Reduce Or Avoid Gift Tax

Foreign Investors Investing In U S Real Estate Sf Tax Counsel

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

Understanding The Rules Of Gifting Brooklyn Fi

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Gifts From Foreign Corporations Included As Gross Income

Tax Tips And Traps Related To Foreign Gifts Gift From Foreign Person

Latest Nri Gift Tax Rules 2019 20 Are Gifts Received By Nris Taxable

Foreign Gift Tax Ultimate Insider Info You Need To Know For 2022

What Is The Gift Tax In India And How Does It Affect Nris

Form 3520 Reporting Foreign Gifts Trusts And Inheritances H R Block